Global shares were buffeted over the last week with hotter than expected US inflation data but better than expected profits results. While US shares hit a new record high, they fell 0.4% for the week. Eurozone shares reached new highs and rose 1.1% for the week. Japanese shares rose 4.3% and are now just 1% below their 1989 high, after a long recovery from their 20-year 82% slump into their 2009 low. Australian shares rose 0.2% for the week with falls in health and resources shares but gains in IT, consumer discretionary and real estate shares. Bond yields rose on the back of higher-than-expected US inflation data. Oil, metal and iron ore prices rose and the $A rose slightly despite a rise in the $US.

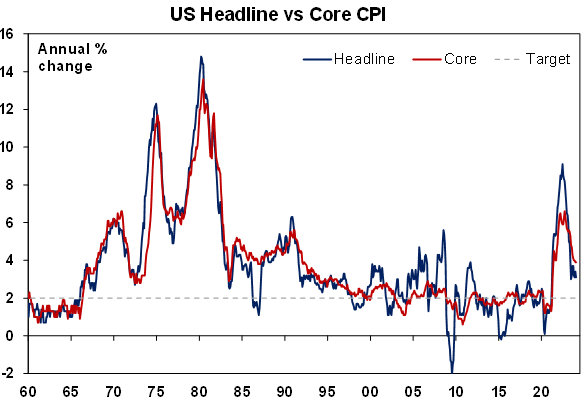

The past week saw another bout of consternation that rate cuts might be delayed after higher-than-expected US inflation. Headline inflation in January fell to 3.1%yoy but core was unchanged at 3.9%yoy. Producer price inflation also came in stronger than expected. The combination of strong economic data and higher than expected inflation and cautious comments from central bankers over the last six weeks have seen market expectations for the start of Fed rate cuts pushed out from March to June and the expected number of rate cuts this year cut from 7 to around 4. Likewise in Australia expectations for the number of rate cuts have been scaled back from nearly 3 to less than 2. However, there is no need to get too concerned.

- First, much of the upside surprise in the US CPI was driven by owner’s equivalent rent (ie, rent imputed to homeowners for the services they get from their home) which rose 0.6% and travel services but slowing asking rents points to slower CPI rent growth ahead and easing wages growth will take pressure off services inflation. In fact, Fed Chair Powell downplayed the hotter than expected January CPI data saying it was “consistent with what they had been anticipating.” Surveyed three year inflation expectations continue to fall in the US and have now fallen back to 2.4%.

- Second, the path to lower inflation was always going to be bumpy and the trend in US and global inflation remains down.

Source: Bloomberg, AMP

- Third, for those worried about a similar flow on to Australia it’s worth noting that the Australian CPI does not include owners’ equivalent rent as we measure owners’ housing costs via new dwelling purchase costs where price growth peaked a while back.

- Finally, the volatility around the US CPI and central bank rate cut expectations reflects share and fixed income markets having run a bit ahead of themselves in terms of central bank rate cuts and what we have been seeing is just a normal correction to that.

While share markets still proved very resilient in the last week, the risk of a near term correction or consolidation remains as the path to lower inflation and interest rates will remain rough for a while yet, recession risk remains high (with the UK and Japan falling into technical recessions in the second half last year and the Eurozone close to it), various geopolitical risks could flare up (notably in the Middle East) and we are now into a seasonally rougher time of year around February/March.

Our broader view remains that central banks will start to cut from some time in the June quarter led by the ECB and Fed (with five 0.25% cuts each) and then the RBA where we continue to see three cuts this year from around mid-year. And this in turn will likely underpin share markets this year. While January jobs data in Australia was likely distorted by seasonal changes around when people take leave and transition to new jobs, the ongoing fall in job vacancies and hours worked and the rising trend in unemployment and labour underutilisation points to a faster rise in unemployment this year than the RBA is allowing for and is consistent with rate cuts ahead as it will contribute to slower wages growth and downwards pressure on inflation.

Swiftonomics and Australian interest rates. For the next two weeks Taylor Swift’s Eras Tour will provide a spending injection into the Australian economy – but does it run the risk of reversing the fall in inflation and delaying rate cuts? It will certainly help the spirits of the roughly 630,000 concert goers and the retailers, hotels, and food outlets that will get some extra spending. If each attendee spends a total of $900 on average associated with the concert (which sounds generous) it will mean spending of $570m – which is a lot of money! But I doubt it will reverse the malaise in consumer spending and threaten a rebound in inflation beyond maybe just brief blip up in this month. Firstly, the bulk of the spend on tickets occurred last year. Secondly, Taylor is an import and so maybe only $400m of that will stay in the country. What’s more $400m is just 0.02% of our $2.6trn economy. And as Governor Bullock implied it will likely come at the expense of other things. So maybe a two-week blip and then back to where we were. So not enough to impact the RBA’s thinking on interest rates. In other words, if you are worried about Swiftonomics delaying cuts in your mortgage rate you need to calm down.

Major global economic events and implications

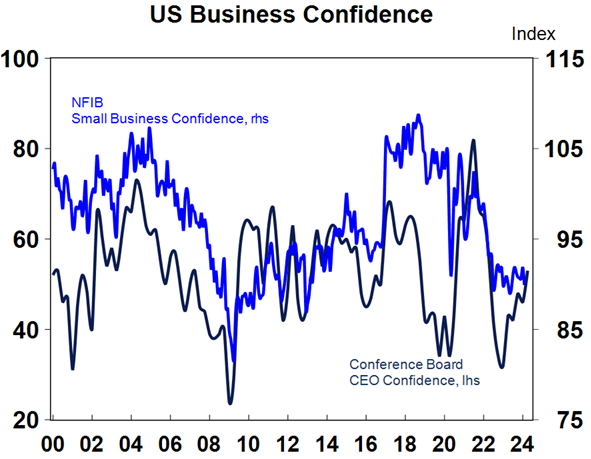

US economic data over the past week was messy. Home builder conditions improved further in February as did CEO confidence and jobless claims remained low. Manufacturing conditions also improved in the New York and Philadelphia regions but on average remain soft and volatile with small business optimism also remaining weak.

Source: Bloomberg, AMP

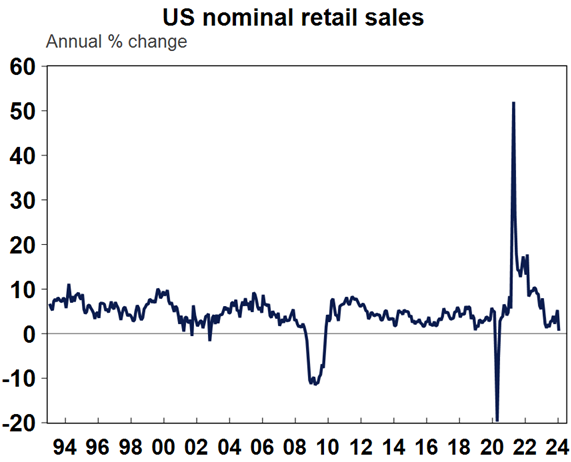

US January retail sales fell sharply both in headline terms and after excluding autos and gasoline but may have been impacted by bad weather. Housing starts fell but again this may have been due to poor weather. Industrial production also fell with manufacturing capacity utilisation falling to its lowest since April 2021 which is a positive sign for inflation. Speaking of which, the prices components of the New York and Philadelphia surveys mostly rose but remain low.

Source: Macrobond, AMP

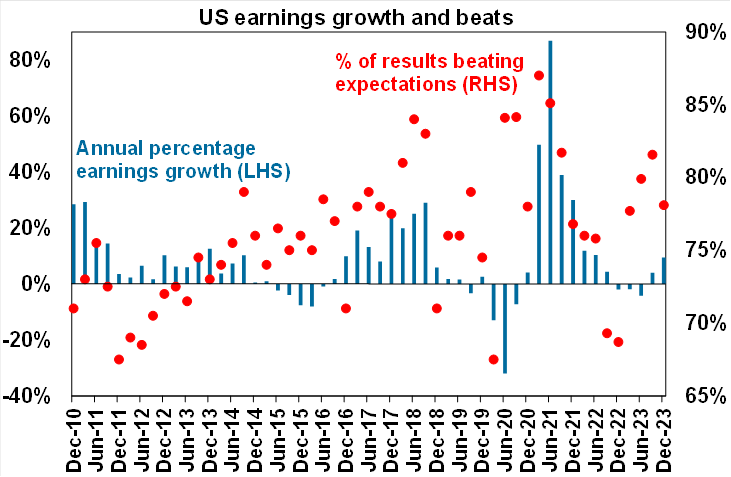

Around 80% of US S&P 500 companies have now reported December quarter earnings with 78% coming in better than expected, which is above the norm of 76%. Earnings growth for the quarter is running around +9.6%yoy, which is well up from consensus expectations for 4.3% growth at the start of the reporting season. Earnings growth has been driven by technology companies (+40%) and financials (+11%) with resources earnings down 21%.

Source: Bloomberg, UBS, AMP

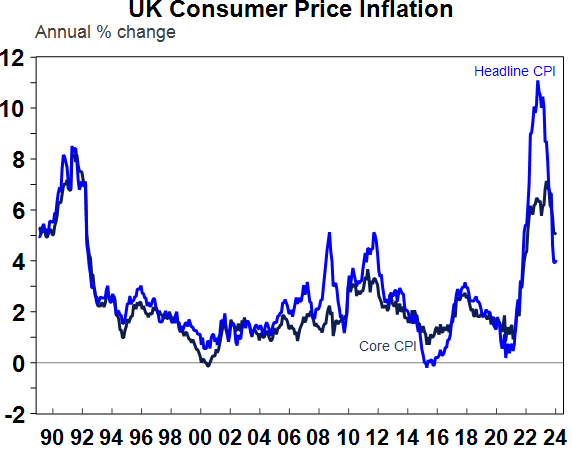

UK inflation came in weaker than expected in January, unchanged at 4%yoy with core inflation also unchanged at 5.1%. Jobs data was stronger than expected in December, but wages growth slowed more than expected to 5.8%yoy from a high last year around 8%yoy. And December quarter GDP fell 0.3% seeing the UK slide into a technical recession after September quarter GDP also fell. The BoE is likely on track for rate cuts this year, but is likely to lag the Fed and ECB.

Source: Macrobond, AMP

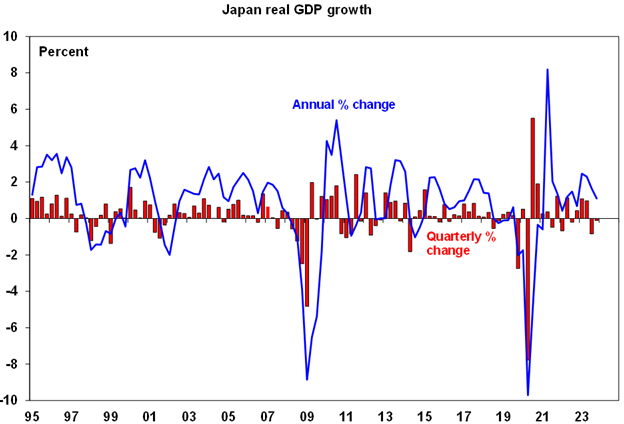

Japanese December quarter GDP unexpectedly contracted for a second quarter in a row, also qualifying as a technical recession, with falls in both consumer and business spending. Growth is likely to bounce back this quarter but the contraction is likely to slow the Bank of Japan’s progress towards rate hikes.

Source: Macrobond, AMP

The slide into technical recessions in the UK and Japan along with the Eurozone very close to it provide a reminder that the risk of recession in Australia is high, but I don’t see much direct impact on Australia. The UK and Japan were already pretty weak having contracted in the September quarter so it’s unlikely to significantly impact demand for our exports. Japan is often in and out of contractions not helped by a falling population (see the previous chart) so it’s nothing really new there and it’s likely to bounce back this quarter. And the UK had been hard hit by 2022’s energy shock and a bigger rise in interest rates making it a bit different to Australia. Of course, were it not super strong population growth of around 2.4% Australia would already be in recession because per capita GDP fell in the June and September quarters. The UK with population growth last year around 0.3% and Japan with a 0.5% fall in its population last year do not have that source of demand support! We continue to see the risk of a traditional recession in the US and Australia this year being around 40%.

Australian economic events and implications

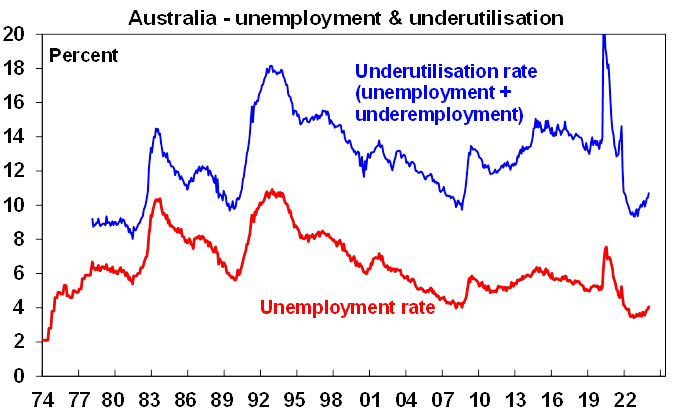

Australian jobs data in January was soft with close to zero new jobs and unemployment rising to 4.1%, which is above 4% for the first time in two years, and labour underutilization rising to 10.7%. There is a need to be cautious in interpreting this though due to seasonal volatility associated with more people on holiday or in between jobs than normal as occurred last year so there may be some reversal in February. However, there is now a clear rising trend in unemployment and underemployment and slowing trend in hours worked.

Source: ABS, AMP

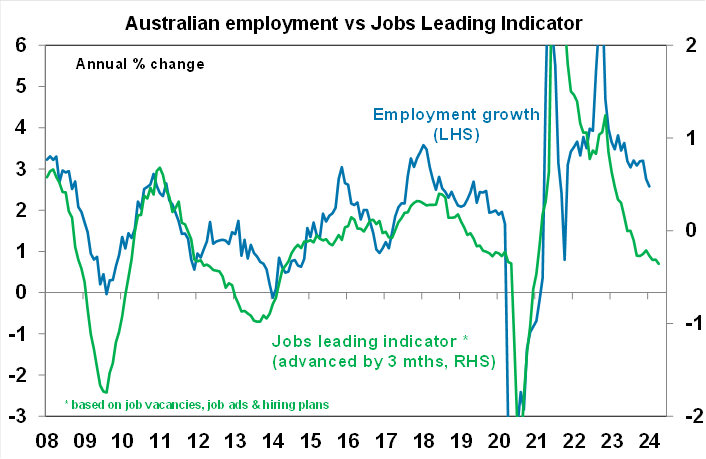

And our Jobs Leading Indicator continues to point to slower jobs growth ahead on the back of falling vacancies and hiring plans. Given the surging population more than 30,000 new jobs are required each month to stop unemployment rising and the Jobs Indicator suggests we will be running below that. The RBA is forecasting that unemployment will rise to 4.3% by year end but there is a good chance that unemployment will exceed this within a few months.

Source: ABS, AMP

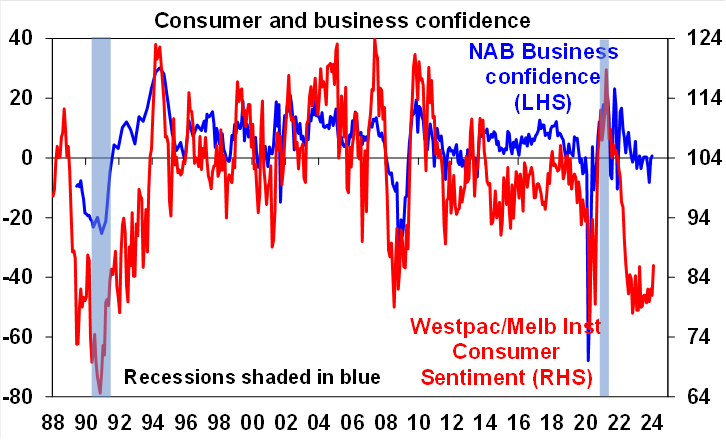

Confidence up a bit but still weak. Consumer confidence bounced in February on rate cut optimism, but still remains weak and survey responses taken after the RBA meeting, where it retained a tightening bias, actually showed a slight fall in confidence compared to January. Business confidence in the NAB survey also improved but remains subdued with business conditions down again. The NAB survey also showed an ongoing decline in hiring plans pointing to slower jobs growth. Taken together this is all consistent with soft growth.

Source: NAB, Westpac/MI, AMP

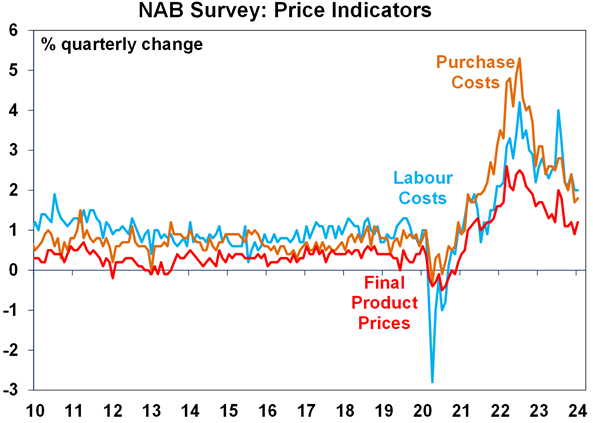

The NAB business survey showed a slight uptick in some price indicators but flat labour costs with the overall trend remaining down which is consistent with falling inflation.

Source: Bloomberg, AMP

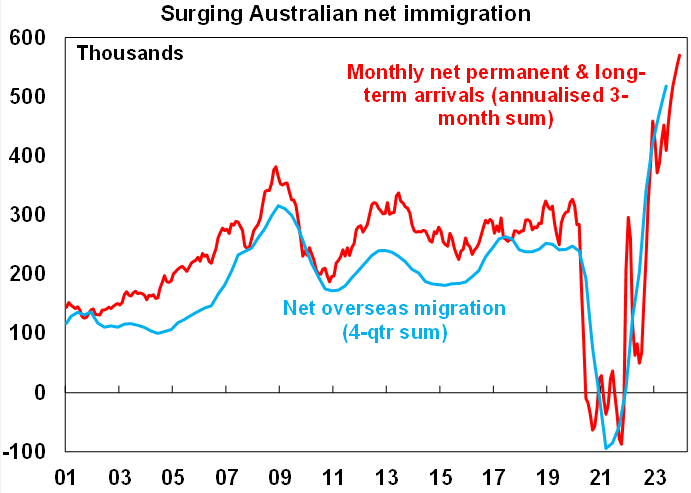

Population boom continuing. Net permanent and long-term arrivals into Australia in December remained very high suggesting population growth may have accelerated even further late last year. It’s probably at the peak but immigration levels (518,000 in the last financial year) are way too high given the housing shortage. Ideally to bring underlying housing demand below the ability to supply homes and cut into the shortfall immigration should be cut back at least to 200,000 a year.

Source: ABS, AMP

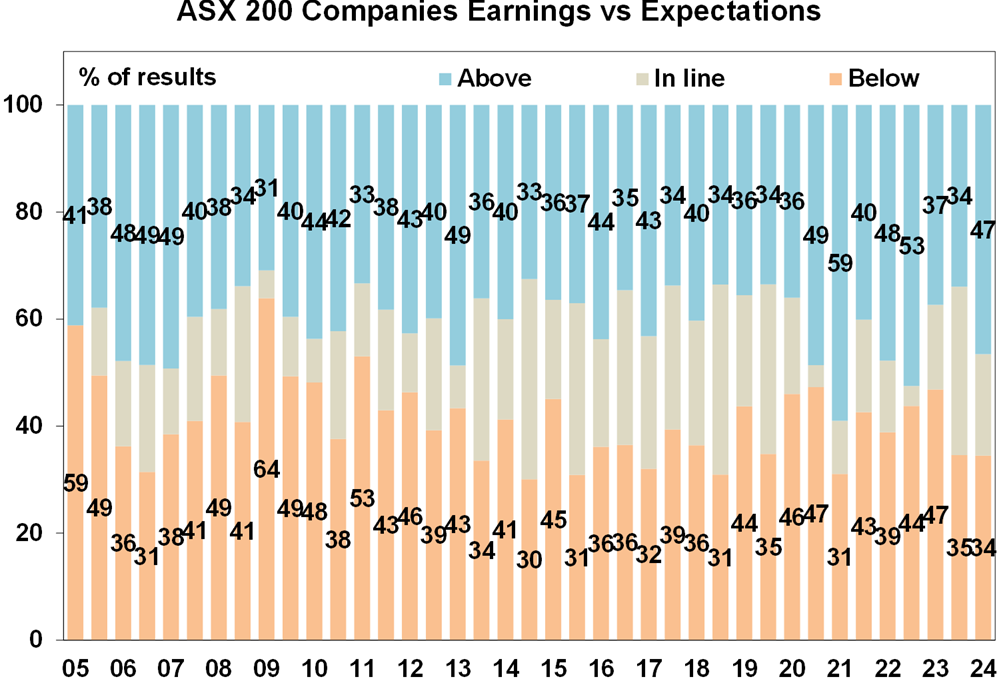

Its early days in the Australian December half earnings reporting season with only 39% of major companies having reported. But so far so good with results generally coming in better than expected. Consensus expectations remain for a 5% or so fall in profits this financial year with a big fall in energy sector profits on the back of lower oil, coal and gas prices and small fall in financial sector profits but most other sectors seeing flat to up profits. So far many of the results for retailers have been better than feared with investors looking through falls in profits to hoped for relief ahead from lower interest rates. So far the results indicate that cost control remains strong and corporate guidance has generally been positive.

- So far 47% of results have surprised consensus earnings expectations on the upside with 34% surprising on the downside, which is better than normal at 41% upside and 41% downside surprise, but this may reflect the tendency of companies with good results to report early.

Source: Bloomberg, AMP

- 52% of companies have seen earnings rise on a year ago, but this is just below the norm of 56% and don’t forget that falls in profits this financial year are likely to be concentrated in energy stocks.

- Only 51% of companies have increased their dividends on a year ago which is well below the norm of 59%, suggesting a degree of caution.

Source: Bloomberg, AMP

What to watch over the next week?

Its PMI week again with January business conditions indices (or PMIs) due Thursday for the US, Japan, Europe, UK and Australia likely to show that the global economy is continuing to grow at a subdued pace with the US and Japan on the stronger side and Europe and Australia on the softer side.

In the US, the minutes from the Fed’s last meeting (Wednesday) are likely to confirm that it’s dropped its tightening bias and now sees things as better balanced and sees rates cuts as likely this year but is not rushing into them.

On the data front expect a further fall in the US leading index (Tuesday) and a rise in existing home sales (Thursday).

In Australia, the minutes from the last RBA meeting (Tuesday) are likely to confirm that its dialled back its hawkishness but still retains a mild tightening bias. Given the RBA’s statement on monetary policy, press conference and parliamentary appearances it should be hard for the minutes to surprise but that should have been the case in the past too and yet they often did. On the data front, December quarter wages data (Wednesday) is likely to show wages growth of 0.9%qoq taking annual growth to 4.1%yoy. This follows a 1.3%qoq rise in the September quarter, which was boosted by the 5.75% increase in award pay and the 8.65% increase in the minimum wage, and would be in line with RBA forecasts.

The Australian December half earnings reporting season will ramp up with nearly 80 major companies reporting including Bluescope, GPT and Lendlease (Monday), BHP, Perpetual and Sonic (Tuesday), Charter Hall, Rio Tinto, Scentre, Stockland and Woolworths (Wednesday), Fortescue, Nine and Qantas (Thursday) and Brambles and Latitude (Friday).

Outlook for investment markets for 2024

Easing inflation pressures, central banks moving to cut rates and prospects for stronger growth in 2025 should make for okay investment returns this year. However, with shares historically tending to fall during the initial phase of rate cuts, a very high risk of recession and investors and share market valuations no longer positioned for recession and geopolitical risks, it’s likely to be a rougher and more constrained ride than in 2023.

Global shares are expected to return a far more constrained 7%. The first half could be rough as growth weakens and possibly goes negative and valuations are less attractive than a year ago, but shares should ultimately benefit from rate cuts, lower bond yields and the anticipation of stronger growth later in the year and in 2025.

Australian shares are likely to outperform global shares, after underperforming in 2023 helped by somewhat more attractive valuations. A recession could threaten this though so it’s hard to have a strong view. Expect the ASX 200 to return 9% in 2024 and rise to around 7900.

Bonds are likely to provide returns around running yield or a bit more, as inflation slows and central banks cut rates.

Unlisted commercial property returns are likely to be negative again due to the lagged impact of high bond yields & working from home.

Australian home prices are likely to have a tougher year as still high interest rates constrain demand again and unemployment rises. The supply shortfall should provide support though and rate cuts from mid-year should help boost price gains later in the year.

Cash and bank deposits are expected to provide returns of over 4%, reflecting the back up in interest rates.

A rising trend in the $A is likely taking it to $US0.72, due to a fall in the overvalued $US & the Fed moving to cut rates earlier and by more than the RBA.

What you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.